In today’s fast-paced world, technology has revolutionized the way we manage our finances and invest our money.

Two popular options that have gained significant attention in recent years are Neo Invest and Wealthsimple Invest.

These robo-advisors offer automated investment solutions, enabling both novice and experienced investors to navigate the complex world of investing.

While they share similarities in their mission to democratize investing, each of them has unique features that distinguish them from one another.

Understanding the key differences between Neo Invest and Wealthsimple Invest is crucial if you’re looking to make informed decisions about your financial future.

In this article, we will compare and contrast Neo Invest and Wealthsimple Invest, exploring their features, investment options, fee structures, and performance.

By examining their strengths and weaknesses, you will gain valuable insights to determine which platform aligns best with your investment goals and preferences.

Let’s delve into the details!

Table of Contents

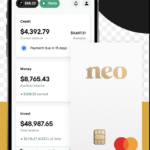

About Neo Invest

Neo Invest, launched by Neo Financial in 2022, is an actively managed robo-advisor that aims to empower Canadians in their wealth-building journey.

The core objective of Neo Invest is to actively manage globally diversified ETF portfolios, enabling investors to access a broad range of investment opportunities.

Neo Invest strives to optimize returns and manage risk on behalf of its users, providing a hassle-free investment experience.

Despite its recency, the robo-advisor has attracted concern from several Canadian investors.

But before signing up with it, it is essential to know how it compares with the existing robo-advisors by evaluating its unique features and drawbacks.

By doing so, you can determine whether Neo Invest aligns with their financial aspirations and offers the right balance of security, growth potential, and convenience.

Learn more about Neo Invest in this comprehensive review.

Pros and Cons of Neo Invest

Below is a quick view of Neo Invest’s pros and cons as they relate to Wealthsimple Invest.

Pros

- Accessibility: Neo Invest offers the flexibility to start investing with as little as $1, making it an ideal choice for beginners with little capital.

- Automated Deposits: Neo Invest simplifies your investing journey by allowing you to set up automatic weekly or monthly deposits. This lets you focus on other important aspects of your life while ensuring consistent contributions to your investment portfolio.

- Tailored Portfolios: Whether you have specific financial goals like saving for your child’s education, planning for a car purchase, managing your mortgage, or preparing for retirement, Neo Invest’s goal-oriented robo-advisor helps you achieve them.

Cons

- Limited Account Options: Neo Invest currently provides only three investment account options, which may not cater to the diverse needs of all investors.

- Higher Fees: Compared to Wealthsimple Invest, Neo Invest has relatively higher management fees and MER, potentially increasing the overall costs for users.

- Lack of Historical Data: Unlike Wealthsimple Invest, Neo Invest doesn’t have data on asset allocations and returns. This absence of information poses a higher level of risk for potential investors who heavily rely on historical performance for decision-making.

About Wealthsimple Invest

Wealthsimple Invest, provided by Wealthsimple Inc, is a passively-managed robo-advisor that was established in 2014.

As a robo-advisor platform, Wealthsimple Invest stands out among its competitors by not imposing a minimum deposit requirement to access its robo-advisor services.

One of the key reasons why many Canadian investors are drawn to Wealthsimple Invest is its “autopilot” approach to investing.

Through Wealthsimple, you can experience the convenience of automated deposits, portfolio rebalancing, and dividend reinvestment.

This helps you focus on other areas of your life by investing hands-off with Wealthsimple Invest.

The robo-advisor offers three distinct risk profiles, enabling investors to align their portfolios with their desired level of risk tolerance.

This flexibility allows users to personalize their investment strategy and potentially optimize their returns based on their comfort levels.

In addition to its versatile risk profiles, Wealthsimple Invest offers a wide range of asset options for portfolio diversification.

You can access Canadian, US, and International stocks on Wealthsimple, helping you expand your investment horizons beyond the Great White North.

Related Best Wealthsimple Alternatives in Canada

Pros and Cons of Wealthsimple Invest

Below is a quick view of Wealthsimple Invest’s pros and cons as they relate to Neo Invest.

Pros

- Cost-Effective: You can participate in a hands-off investment approach without worrying about annual or inactivity fees with Wealthsimple Invest. This cost-effective structure allows individuals to focus on their investment strategies without unnecessary financial burdens.

- Tax-Loss Harvesting: Wealthsimple Invest offers a unique feature known as tax-loss harvesting, which can help reduce your capital gains tax on unregistered investments.

- No Minimum Balance: Like Neo Invest, Wealthsimple Invest doesn’t also a require minimum balance on investment. You can start investing with it even with $1. This allows you to invest according to your budget without any pressure to meet a specific deposit threshold.

- Autopilot Investing: With Wealthsimple Invest, handles everything on your behalf. This includes automating deposit contributions, portfolio rebalancing, and dividend reinvestment. This enables you to focus on other important aspects of your life.

- Expert Financial Advisors: While the platform uses a passive investing strategy, it recognizes the value of professional guidance. Wealthsimple Invest offers the support and expertise of financial advisors who can assist you throughout your investment journey. This combination of automated investment management and expert advice provides a comprehensive investment experience.

Cons

- Expensive: Even though Wealthsimple Invest has lower fees than Neo Invest, it still has a high management fee and MER. This makes it a potentially more cost-effective choice for investors seeking to minimize fees while maintaining a diversified investment portfolio.

Neo Invest vs Wealthsimple Invest: Detailed Comparison

| Name | Neo Invest | Wealthsimple Invest |

| Year founded | 2022 | 2014 |

| Provider | Neo Financial | Wealthsimple |

| Portfolio management strategy | Active | Passive |

| Portfolios | ETF portfolios | ETF, Halal, & SRI portfolios |

| Investment accounts | Personal, TFSA, and RRSP accounts | Personal, business, RRSP, RRIF, TFSA, RESP, and LIRA accounts |

| Minimum investment | $1 | $1 |

| Management fee | 0.75% | 0.4% to 0.5% |

| MER | 0.4% to 0.5% | 0.13% to 0.16% |

Neo Invest vs Wealthsimple Invest: Portfolios

Neo Invest offers what they call Themed Portfolios, which are designed as value-investing vehicles.

These ETF portfolios provide a unique opportunity to combine traditional and alternative investment approaches within a single investment portfolio.

On the other hand, Wealthsimple Invest takes a slightly different approach with its portfolio offerings.

They have three broad categories to cater to investors with varying financial goals and risk tolerance.

These categories include classic ETF portfolios, SRI (Socially Responsible Investing) portfolios, and Halal portfolios.

Each of these categories is further divided into conservative, balanced, and growth portfolios.

All Wealthsimple portfolios offered have the same management fees of 0.50%.

However, they differ in terms of asset allocations, the Management Expense Ratio (MER) of the underlying Exchange-Traded Funds (ETFs) they invest in, and the associated risk profiles.

For the purpose of this review below is an overview of the classic ETF portfolios of Wealthsimple Invest:

| ETF Portfolio | MER | Allocation | Risk Profile |

| Conservative portfolio | 0.16% | 30%-40% equity | Low |

| Balanced portfolio | 0.16% | 50-65% equity | Low to medium |

| Growth portfolio | 0.13% | 75-90% equity | Medium to high |

Overall, Wealthsimple Invest offers a range of portfolio categories tailored to different investment goals and risk tolerance levels.

Neo Invest vs Wealthsimple Invest: Accounts

When it comes to the types of investment accounts offered, Neo Invest and Wealthsimple Invest also differ in their offerings.

Neo Invest provides investors with three distinct types of investment accounts.

This includes a personal account, Tax-Free Savings Account (TFSA), and Registered Retirement Savings Account (RRSP).

On the other hand, Wealthsimple Invest offers a wider array of investment account options, making it more versatile for investors with varying financial goals.

As of the time of writing this, Wealthsimple Invest offers an extensive selection of account types to choose from. These include:

- Individual

- Joint

- Business

- TFSA

- RRSP

- Registered Retirement Income Fund (RRIF)

- Registered Education Savings Plan (RESP)

- Locked-In Retirement Account (LIRA)

In summary, while Neo Invest offers a more limited selection of investment accounts, Wealthsimple Invest presents a broader range of options.

Neo Invest vs Wealthsimple Invest: Fees

Robo-advisors charge management fees and a management expense ratio (MER).

The management fee stands at 0.75% while the MER ranges from 0.4% to 0.5% at Neo Invest.

Compared to Wealthsimple Invest, Neo Invest has a higher fee schedule.

For investments under $100,000, Wealthsimple Invest charges a management fee of 0.5%, while for investments of $100,000 and above, the fee is reduced to 0.4%.

Additionally, Wealthsimple Invest MERs are lower compared to Neo Invest’s.

The MER for the classic ETF portfolios ranges between 0.13% and 0.16%. For socially responsible investment (SRI) portfolios, the MER is 0.50%, and for Halal portfolios, it ranges from 0.25% to 0.5%.

While Wealthsimple Invest fees are among the highest out there, they are lower compared to Neo Invest’s fees.

Neo Invest vs Wealthsimple Invest: Performance

As a new robo-advisor, Neo Invest has not provided returns yet. It should have by now but we don’t have data to that effect.

However, Wealthsimple Invest has provided competitive returns since its inception.

The following are the net of fees returns of Wealthsimple classic ETF portfolios from inception (August 20, 2014) to November 30, 2022.

| Portfolio | Returns |

| Conservative | 17.39% |

| Balanced | 27.24% |

| Growth | 56.29% |

Note that the Wealthismple performance page is currently under development. You can visit it later to see the current performance data.

With portfolio returns to evaluate, you will have more confidence predicting the performance of your Wealthsimple Invest portfolio than a Neo Invest portfolio.

Neo Invest vs Wealthsimple Invest: Safety

Both Neo Invest and Wealthsimple Invest are safe as per industry standards.

Investment with any of the robo-advisors is guaranteed up to $1 million by the Canadian Investor Protection Fund (CIPF).

The activities of Neo Invest and Wealthsimple Invest are also regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

Overall, you don’t have to bother about safety when deciding which of the two robo-advisors to choose.

Neo Invest vs Wealthsimple: Which to Choose?

From the above comparison, you have seen how the two robo-advisors differ. But if you find it difficult to narrow your selection, consider the following factors.

1. Management Strategy

As noted earlier, Neo Invest uses an active strawberry while Wealthsimple Invest uses a passive strategy.

Robo-advisors with active management employ human experts or algorithms to actively select and manage investments.

Active management aims to outperform the market by actively buying and selling securities based on market conditions and investment opportunities.

This approach typically incurs higher management fees due to the additional research and analysis involved.

On the other hand, robo-advisors with passive management typically follow a “set it and forget it” approach, aiming to match the performance of a specific market index.

Passive management involves investing in a diversified portfolio of low-cost index funds or ETFs.

This approach generally results in lower management fees due to the lower costs associated with passive investment strategies.

For passive, consider Wealthsimple Invest

Active management may be suitable if you seek potentially higher returns but are comfortable with higher fees and the associated risks.

On the other hand, passive management may be a better fit if you prefer a hands-off approach with lower fees and a focus on long-term market performance.

2. Available Account Types

The two robo-advisors have different collections of account types.

From the above comparison, you can see that Wealthsimple Invest has a more robust collection of investment accounts than Neo Invest.

By considering the available account types, you can choose a robo-advisor that offers the necessary account options to meet your specific investment needs in Canada.

3. Portfolio Types

When choosing the perfect robo-advisor in Canada, you want to look for a robo-advisor that offers a variety of portfolio options to suit your investment preferences.

While Neo Invest supports only ETF portfolios, Wealthsimple supports ETF, SRI, and halal portfolios.

While past performance does not guarantee future results, it can provide insights into the robo-advisor’s investment strategy and its ability to generate returns over time.

As such, you want to also compare the portfolio performance of Neo Invest vs Wealthsimple.

Although at the moment, you don’t have the data to do so as Neo Invest doesn’t have performance data yet. So you can either take the risk or go with Wealthsimple Invest.

4. Fees

Finally, you want to narrow your selection based on the robo-advisors’ fee schedules.

As noted earlier, Neo Invest has higher fees than Wealthsimple Invest

But while low fees are desirable, it’s also crucial to assess the value provided by the robo-advisor before finalizing.

As such, you need to consider the fees alongside the robo-advisor’s features, performance, and customer support.

Overall, you should evaluate whether the fees charged are reasonable in relation to the benefits and services provided.

Do you want to handle your investment yourself? Consider Qtrade